Team BigCity - June 12, 2024

Our Role: Strategy | Ideation | Technology | Partner Management | Rewards | Fulfilment

Overview

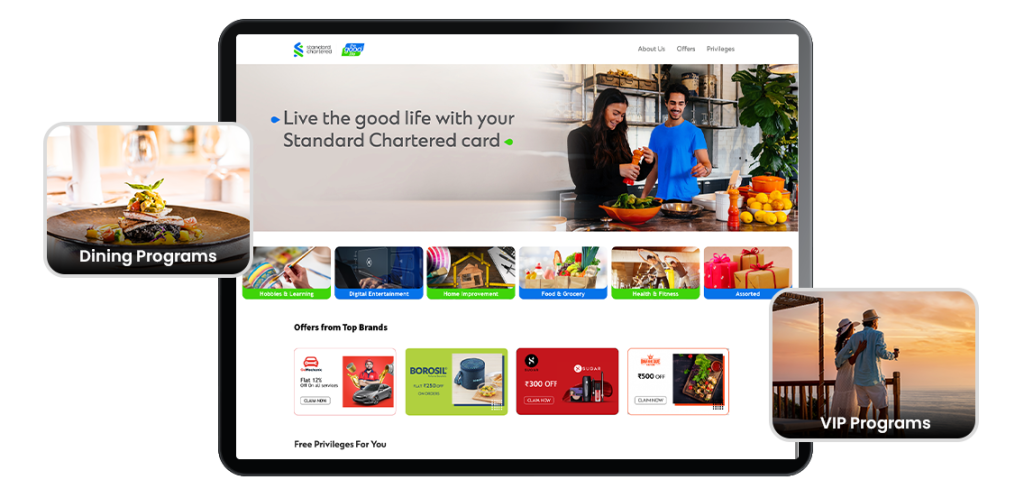

Banks and financial institutions by their very nature have fewer customer touch points and therefore need to ensure they maximise their engagement opportunities with their customers. During the Covid lockdown it was more important than ever for banks to stay relevant and create reasons to keep their brand front of mind with customers.

We therefore created a range of highly relevant “At Home” rewards and offers that customers could redeem and use during lock down. Rewards that would give customers a better life during this challenging period. Categories included hobbies / learning, digital entertainment, home improvement, grocery and health and fitness. All of which could be accessed by simply inputting your card numbers.

Impact

Providing customers with a range of ways to have a ‘Better Life’ in such unprecedented conditions and unchartered waters created a highly emotional bond between the bank and many of its customers. Unique situations, require unique solutions and creating a little bit of the good life at a time when everyday life was extremely challenging for people was an extremely powerful thing to do.

Our platform is designed to handle both, giving clients full flexibility. Our core B2B/Trade Loyalty programs are long-term strategies, often sustained for an average program tenure of 4 years, focused on building retention and maximizing partner lifetime value. However, we also execute short-term, tactical campaigns—or 'short-burst schemes'—such as scratch cards, lucky draws, and high-sales contests, to drive immediate spikes in sales or achieve quarterly targets.

Success is measured through a set of critical Key Performance Indicators (KPIs) tracked in real-time. These metrics cover two key areas:

1. Financial Outcomes: Tracking Sales Uplift (incremental revenue generated), Customer Lifetime Value (CLV), and Average Order Value (AOV) to ensure financial profitability.

2. Behavioural Metrics: Measuring Customer Retention Rate (or churn reduction), program Enrolment and Participation Rates, and the Frequency of Purchases to confirm that the program is successfully changing partner behaviour.

For well-designed and executed B2B loyalty programs, a strong return is primarily driven by:

• Retention: Significantly reducing customer or partner churn, as retaining a client is far more cost-effective than acquiring a new one.

• Incremental Sales: Ensuring that rewards are paid out only for performance that exceeds existing sales baselines, making the program self-funding based on growth.

• Wallet Share: Incentivizing channel partners to prioritize and sell a greater share of your products over a competitor's.

Our expertise spans a comprehensive range of sectors that rely on robust channel partner and trade networks for success. We routinely power campaigns for major brands in Automotive, FMCG, Retail, Consumer Durables, Building Materials (including cement, paint, and sanitaryware), Electrical Equipment (like lighting and switchgear), Oil & Lubricants, and Pharmaceuticals, Financial Services, Telecommunications, and Technology sectors. Essentially, any business that leverages a network of dealers, distributors, retailers, or third-party influencers—such as mechanics, architects, or contractors—to drive product sales can utilize our fully customized B2B loyalty solutions.

A promotech company specializing in tactical and loyalty campaigns, offering Retailer Programs, Influencer Programs, Distributor Programs, and Sales loyalty Programs. We leverage rewards, engagement-based technology, and loyalty strategies backed by AI and insights.